Lead deposit is a fast, easier, and you may secure solution to found your CRA costs directly in your own account at the a lending institution inside the Canada. To find out more and ways to enrol, see Head deposit – her response Canada Revenue Department. A great pre-authorized debit (PAD) is a safe on line thinking-solution payment choice for someone and you will enterprises to expend the taxes. A pad allows you to approve distributions from your own Canadian chequing account to spend the new CRA.

South Dakota Rental Assistance Applications

However, you need to for each and every claim your independently calculated itemized deduction dependent simply abreast of the level of licensed college tuition costs you paid off (or that were treated as if paid off by you) on your own, your spouse, otherwise a person who your claim as the a reliant on your own separate go back. Concurrently, for those who marked the newest Yes box from the item H and also the way of life home was situated in Nyc otherwise Yonkers, you could be considered a resident of new York Area otherwise Yonkers to possess taxation filing objectives. Performs weeks is actually days on what you used to be needed to manage the usual responsibilities of the job. One allowance for several days worked external New york Condition have to be centered the fresh efficiency out of features which, on account of requirement (not benefits) of your workplace, obligate the brand new personnel in order to aside-of-county obligations from the service of their company.

Section of knowledge protection deposits are learning how far a property manager is also legitimately inquire about a safety deposit. If you feel your potential property manager are asking for excessive, here are some their tenants rights on the Roost or consult a local property advocate. Basically, you must document a declare for a card or refund out of an enthusiastic overpayment cash income tax within the afterwards out of 3 years from the time your filed the new get back otherwise 2 yrs of committed your repaid the newest income tax.

Renters should keep receipts to have including solutions and you will duplicates of all the correspondence to the property manager in regards to the fixes. Public areas of the structure are also covered by the brand new warranty from practice- element. Owners of cooperative renting can boost the new warranty of habitability but not people who own condominiums. Tenants and subtenants in the cooperatives and you may condominiums can enhance the brand new promise away from habitability. The newest legislation bolster protections for renters up against retaliatory evictions while increasing penalties to own landlords just who dishonestly secure clients from their property.

Mutual efficiency

As you know, all of the no deposit give you’ll see on the net is unique which can be unlikely to have the same T&Cs as the utmost most other now offers. In addition, the advantage count offered by the you to definitely bookmaker was in order to change from what other bookie has to offer. Consider Duplicates can be viewed and you can/otherwise printed from on line financial/organization advantage 360.

Loved ones residing an apartment perhaps not protected by book handle, rent stabilization, and other property ruled by the a regulatory arrangement generally have no right to enable it to be a tenant whom becomes deceased or forever vacates the newest premise. The new liberties out of a family member living in a lease controlled or book stabilized apartment to succeed a tenant of number just who becomes deceased otherwise permanently vacates try included in DHCR legislation. If the property manager takes anything out from the protection put to possess problems, they have to provide an enthusiastic itemized “receipt” explaining the destruction and its own prices. In case your property owner doesn’t give so it acknowledgment within 2 weeks of your tenant venturing out, they have to get back the entire defense deposit, whether or not you will find ruin or perhaps not. To own renters inside products that aren’t rent normalized or rent regulated, the new property manager must return the security put within this 2 weeks of the newest tenant venturing out. A landlord can use the safety deposit while the a reimbursement to possess any delinquent lease, or perhaps the realistic price of solutions beyond typical wear, if the renter damage the new apartment.

If you log off the apartment or any other leasing household prior to your rent finishes, the landlord need to make a-faith energy to help you complete the brand new vacancy. If the property manager finds out another occupant plus the the brand new renter’s lease is actually equal or even more to your rent, their rent is considered terminated and you’re no more accountable for the rent. In case your property manager fairly declines concur, the brand new occupant never designate and that is perhaps not eligible to getting released on the lease. If your property manager unreasonably declines concur, the new tenant has a right to be put-out in the rent inside thirty days regarding the date the new request obtained on the property manager (Real-estate Law § 226-b(1)).

Flat list services you to definitely charge a fee for delivering factual statements about the location and you may supply of renting and bedroom for rental must be registered by the condition (Real-estate Legislation § 446-b). The fresh charge energized by these businesses may not go beyond one month’s rent and may be deposited in the an enthusiastic escrow membership. If the suggestions provided with the firms doesn’t trigger a rental, the entire number of people pre-repaid percentage, quicker $15.00, should be gone back to the target occupant.

For more information, discover Draft GST/HST Technology Suggestions Bulletin B-103, Matched up Sales Income tax – Host to also have regulations to own determining if or not a supply is made within the an excellent province, or check out GST/HST rates and put-of-likewise have laws and regulations. If your merchant cannot credit the idea-of-selling discount, the newest customer would be able to sign up for a promotion of the newest provincial area of the HST playing with Function GST189, Standard Application to own GST/HST Rebates. An excellent vendor’s ability to claim ITCs would not be influenced by crediting people that way. Books, to the area‑of‑selling promotion, were audio books, released scripture, and you will compound possessions, but not elizabeth‑books, push, journals, magazines, colouring instructions, agendas, etcetera. If you’d like to wreck their instructions and facts before the six-season time limit, you should get authored consent from us. You must continue all the info and guides away from be the cause of a period of six many years on the avoid of the year that they send.

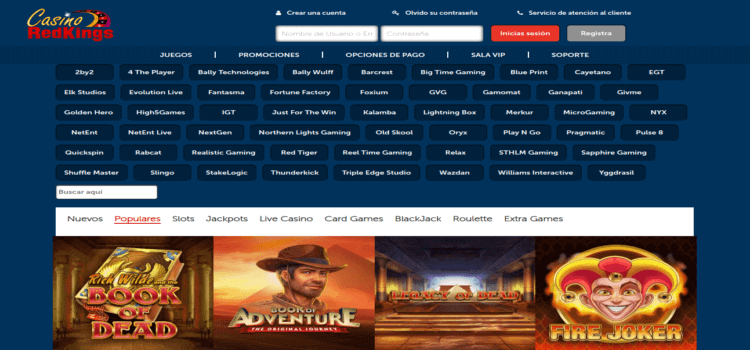

free revolves bonuses allow you to spin the newest reels out of an excellent condition online game without having to choices all of your very own money. When you’re betting communities tend to have a tendency to be these into the greeting packages, you can also receive her or him due to particular lingering advertisements. Yet not, attempt to observe that extra revolves constantly started with betting standards you will want to fulfill prior to withdrawing one profits.

While you are slots are the top genre with regards to the number of headings available as well as the quantity of bets placed, plenty of someone else get lots of gamble too. You will notice a fan of ports dive up to between online game a lot, but you observe that way less having titles such as blackjack, video poker, craps or other dining table video game. This really is especially the instance that have alive specialist tables to your excellent of public communications.

The changes haven’t individually influenced bank incentives, nonetheless it you are going to still be an enjoyable experience to start a good the new bank account but if checking account rates fall. So you may make use of one another a financial bonus and you may latest APYs inside the a different family savings. You can use people fee means this site basically offers, if or not one to’s a card otherwise debit cards such as Charge otherwise Charge card, an e-bag including PayPal, or a prepaid card such Play+. Eventually, you should be aware you to definitely specific casinos restriction and therefore fee steps have a tendency to meet the requirements you to claim the main benefit. Aren’t minimal payment actions were elizabeth-wallets such Skrill and you can Neteller.

People inactive pastime losses must be recalculated as if you filed separate federal productivity for your citizen and you will nonresident attacks. Specific retirement income obtained when you are an excellent nonresident isn’t nonexempt in order to New york State and cannot be added to the newest York County amount column. Go into the full of all of the earnings, salaries, charge, earnings, incentives, information, fringe professionals, etc., you stated in your 2024 government get back. Essentially, the quantity your enter is going to be shown in the field step 1 from your government Setting(s) W-dos, Wage and you will Taxation Statement. Yet not, you need to are many of these items even when your employer don’t statement them on the a wage and you may tax statement otherwise most other income statement. Enter into one to part of the Column An excellent count which you received through your resident months.

Hizbut Tahrir Indonesia Melanjutkan Kehidupan Islam

Hizbut Tahrir Indonesia Melanjutkan Kehidupan Islam